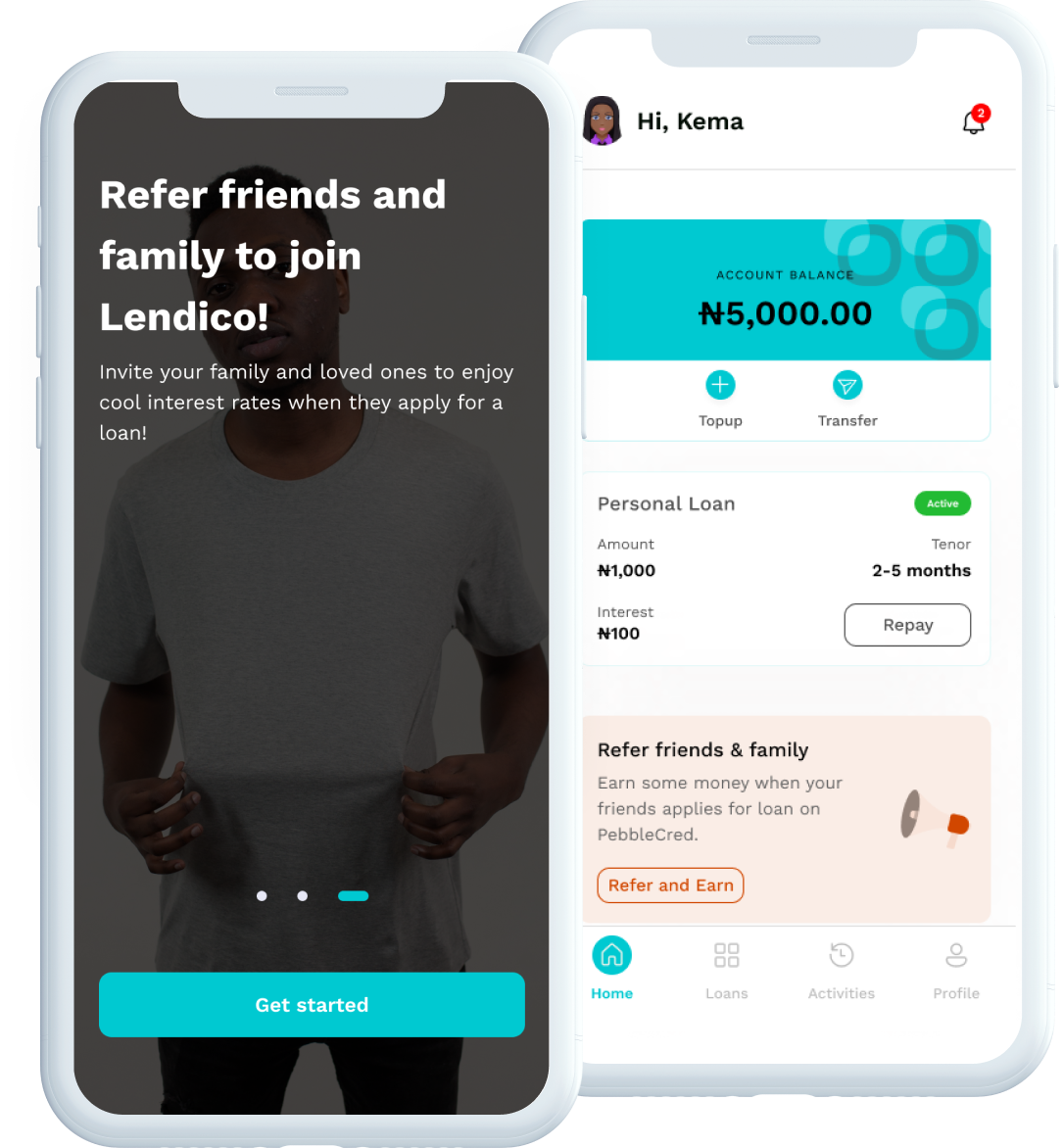

Easy Credit at your fingertips!

Low on cash? Apply for low interest loans from your mobile device whenever through an easy and seamless process.

At Lendico, we are passionate about providing loans to help you scale your business, pay educational fees and meet your personal needs.

With our seamless application process, you can apply for a loan in no time and get it disbursed to your account

Your information is safe with us: With our secure online platform, we protect all your personal information and confidential details using the highest level of encryption.

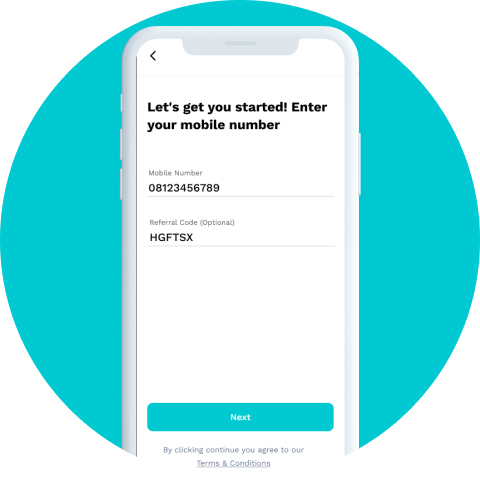

Step 1

Download our app from App Store or Play Store and sign up

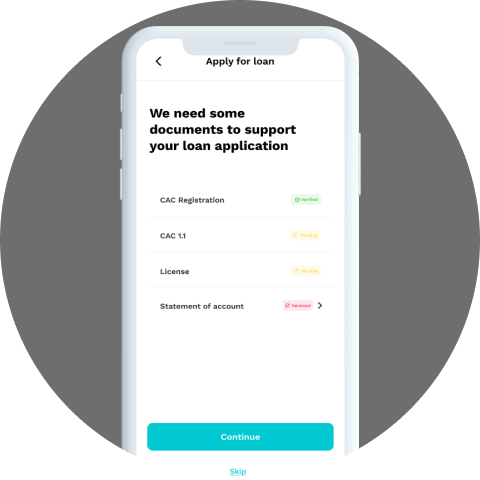

Step 2

Submit a valid identification document

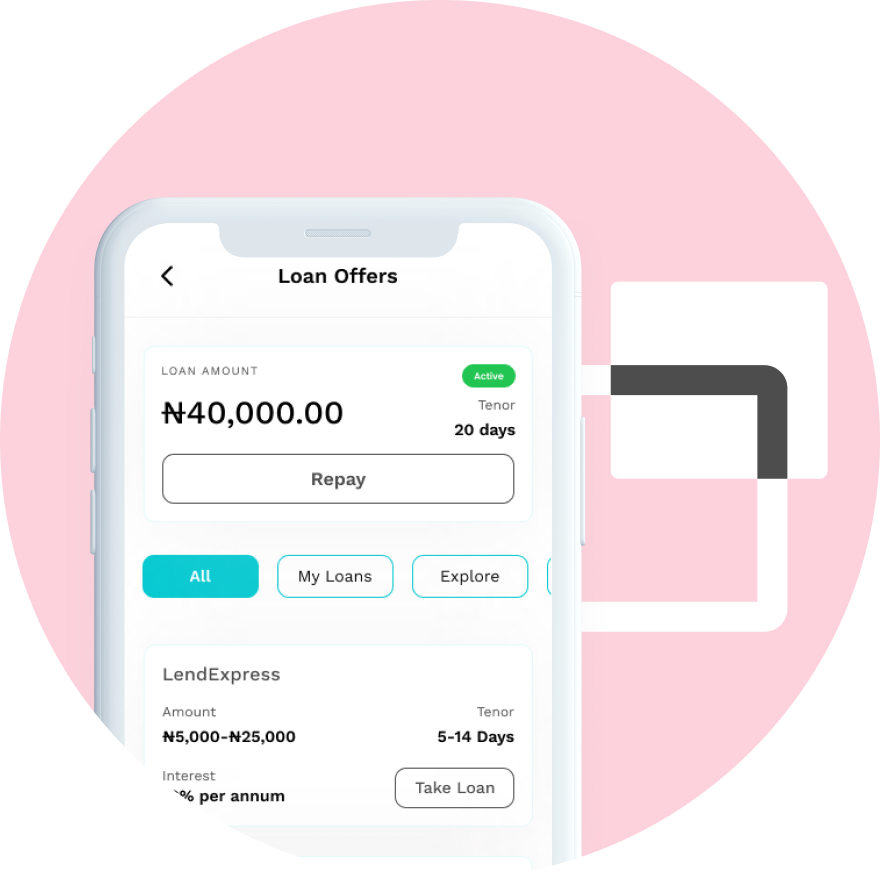

Step 3

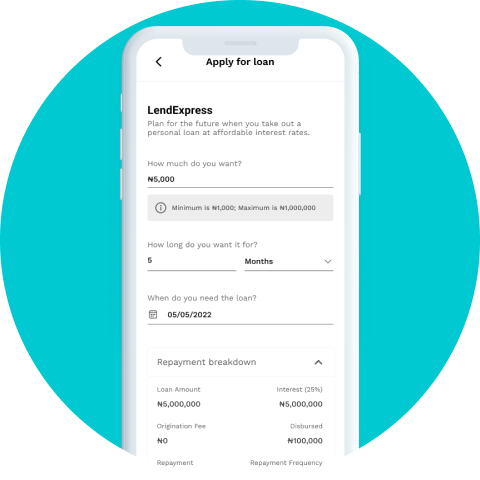

Complete your loan application

Step 4

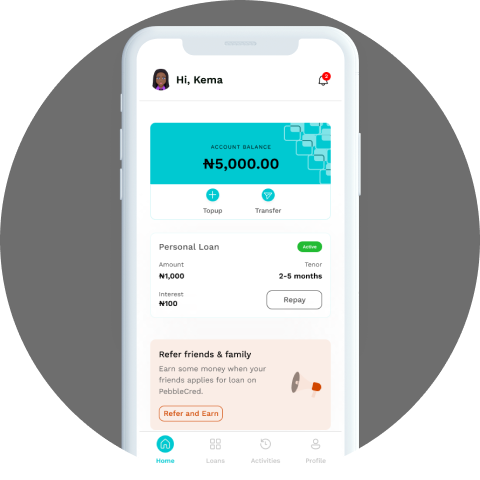

If eligible, you get your loan amount credited within 24 hours